What Does Relationship to Policy Holder Mean

Relationship to policy holder refers to the connection or association an individual has with the person who owns the insurance policy. This relationship can determine the ability to access certain benefits or services.

Understanding the relationship to the policy holder is important for navigating the terms and conditions of the insurance policy and ensuring that the correct individuals are authorized to make decisions or receive coverage. It can impact the level of support and resources available to the individual in the event of a claim or need for assistance.

By clarifying the relationship to the policy holder, individuals can make informed decisions about their insurance coverage and uphold the rights and responsibilities associated with their connection to the policy owner.

Defining The Policy Holder Relationship

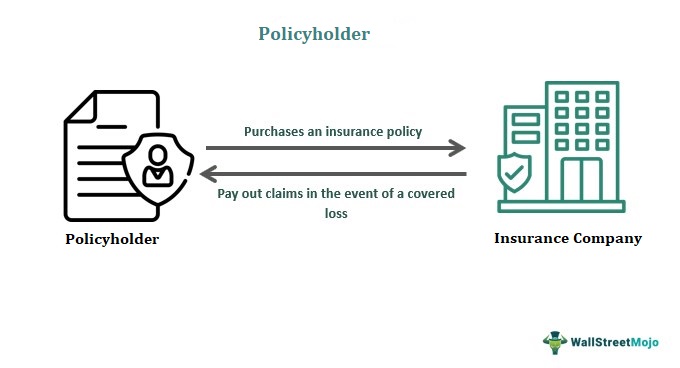

Understanding the relationship to a policy holder is crucial in comprehending the dynamics of insurance coverage. It refers to the connection between the insured individual or entity and the insurance policy. The relationship to the policy holder determines the rights, responsibilities, and benefits associated with the policy. In the following sections, we will delve into the significance and implications of the policy holder relationship.

What Does Relationship To Policy Holder Mean

The relationship to the policy holder signifies the connection between the insured party and the insurance policy. It defines the mutual obligations, rights, and benefits between the two entities. Understanding this relationship is vital in determining the scope of coverage and the parties involved in insurance transactions.

Importance Of Policy Holder Relationship

The importance of the policy holder relationship lies in its role in shaping the dynamics of insurance coverage. It influences the scope of protection, rights to claims, and communication channels between the insured individual or entity and the insurance provider. Establishing a clear understanding of this relationship is essential in managing insurance policies effectively.

Rights And Responsibilities

In the relationship to a policy holder, there are specific rights and responsibilities that are important for all parties involved in an insurance policy. Understanding these rights and obligations can help ensure transparency and fairness in the management of insurance policies.

Beneficiary Rights And Obligations

Beneficiaries of an insurance policy have certain rights and obligations that shape their relationship with the policy holder. These include:

- Rights: The right to receive the benefits outlined in the policy upon the death of the insured.

- Obligations: Providing accurate and updated information to the insurance company, such as changes in contact details or personal circumstances.

Policy Holder’s Rights And Duties

The policy holder also holds specific rights and responsibilities in the insurance relationship. These encompass:

- Rights: The right to make changes to the policy, such as updating beneficiaries or coverage amounts, within the terms of the policy agreement.

- Duties: Paying premiums on time and providing truthful information to the insurance company when applying for the policy or making a claim.

Types Of Relationships

When it comes to insurance policies, the relationship to the policyholder is crucial in determining the coverage and benefits that individuals are entitled to. Understanding the different types of relationships defined in insurance policies is essential for clarity and transparency in the policy terms.

Spouse And Dependent Relationships

Spouse and dependent relationships refer to individuals who are directly related to the policyholder. In the context of insurance, spouses and dependents can be beneficiaries of certain policy benefits. Spouses are typically recognized as primary beneficiaries and are entitled to financial support or coverage in the event of the policyholder’s death or disability. On the other hand, dependents can include children or other family members who rely on the policyholder for financial support. Insurance policies often outline specific criteria for defining dependents and the extent of their coverage.

Business Partner And Employee Relationships

In the realm of business insurance, the relationships between business partners and employees are crucial factors. Business partners may have vested interests in the company’s assets or operations, and their relationship to the policyholder can influence the terms of coverage. Additionally, employees are often beneficiaries of group insurance policies, receiving coverage for medical expenses, disability, or life insurance. Companies must clearly establish the scope of coverage for business partners and employees to avoid potential disputes or misunderstandings in the event of a claim.

Impact On Claim Processes

The relationship to the policy holder can have a significant impact on claim processes. It can affect the speed and efficiency of claims processing, as well as the level of communication and cooperation between the insurance company and the policy holder.

This relationship can ultimately influence the overall outcome of the claim.

Impact on Claim Processes The relationship to the policyholder plays a crucial role in the claim processes in insurance. Understanding the impact of this relationship can help the policyholder navigate the claim approval, disputes, and resolutions effectively. Policy Holder Relationship The relationship between the insurance company and the policyholder directly affects the claim process. A positive and transparent relationship can streamline the claim approval process, while a strained relationship may lead to delays and disputes. Claim Approval The policyholder’s relationship with the insurance company can influence the speed and efficiency of claim approvals. Clear communication and a good rapport can expedite the approval process, enabling the policyholder to receive the necessary compensation without unnecessary delays. Disputes and Resolutions In case of disputes, the relationship to the policyholder becomes crucial in determining the fairness and effectiveness of claim resolutions. A cooperative relationship can lead to amicable resolutions, while a contentious relationship may prolong the dispute resolution process. In situations where the policyholder and the insurer have a positive relationship, there is often a quicker and smoother dispute resolution. Conversely, a strained relationship can lead to prolonged disputes and potential legal intervention. In conclusion, the relationship to the policyholder has a significant impact on claim processes, influencing the speed, efficiency, and fairness of claim approvals, disputes, and resolutions. A positive and transparent relationship is key to optimizing the claim process and ensuring a favorable outcome for the policyholder.Improving Policy Holder Relationships

Communication And Transparency

Effective communication and transparency are vital components in improving the relationship with policy holders. Open and clear communication fosters a sense of understanding and trust between the insurance provider and the policy holder. Clients appreciate updates and information regarding their policies in a timely and transparent manner, thus establishing a sense of reliability and dependability on the part of the provider.

Trust And Mutual Understanding

Building trust and mutual understanding between the insurance provider and policy holders is crucial for a successful and enduring relationship. Establishing trust involves displaying consistency, honesty, and integrity in all interactions. Clients are more likely to remain loyal when they feel understood and valued. A mutually beneficial relationship relies on the provider’s ability to empathize with the needs and concerns of the policy holder and address them effectively.

Frequently Asked Questions Of What Does Relationship To Policy Holder Mean

What Is Relationship To Policy Holder?

The relationship to policy holder refers to the connection or association an individual has with the person who holds an insurance policy.

Why Is Understanding It Important?

Understanding the relationship to the policy holder is crucial for determining the rights and privileges an individual has in relation to the insurance policy.

How Does It Impact Insurance Claims?

The relationship to policy holder can significantly impact the process and outcome of insurance claims, influencing who may be eligible to receive benefits.

Can Multiple Individuals Have This Relationship?

Yes, multiple individuals can have a relationship to the policy holder, such as spouses, children, or other dependents named in the policy.

What Are Common Types Of Relationships?

Common types of relationships to the policy holder include spouse, child, beneficiary, or other designated individuals outlined in the policy.

Conclusion

Understanding the relationship to the policyholder is crucial for navigating insurance processes. It impacts benefits, claims, and coverage. As a policyholder, knowing your relationship is important for making informed decisions. Being aware of the implications can help you in managing your insurance effectively.

Get the most out of your policy by understanding your relationship to the policyholder.